Best Institute for CA in Karachi & Pakistan

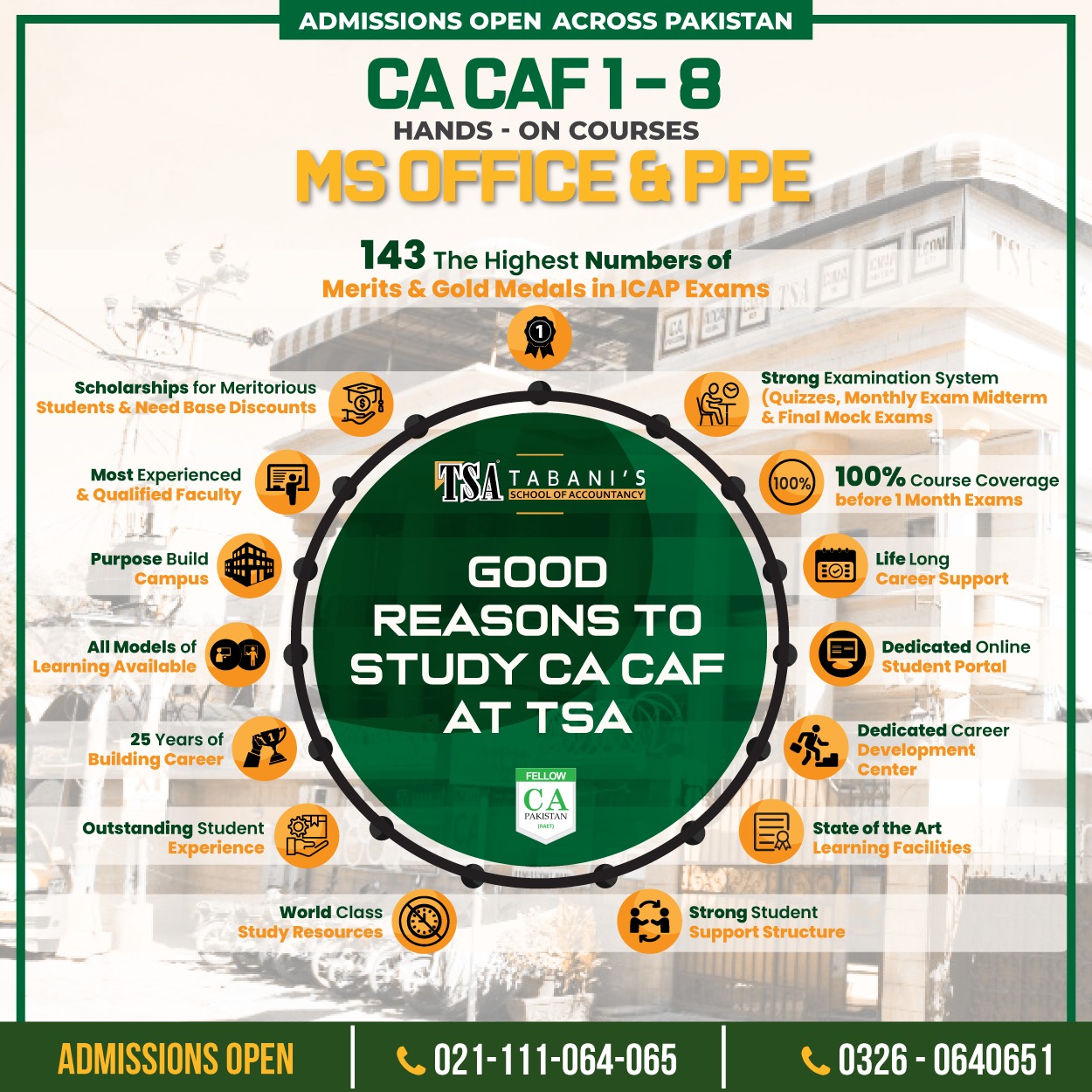

Why CA IN TSA?

Tabani’s School of Accountancy is the leading and best institute for CA in Pakistan, providing experienced and expert faculty for CA subjects who are well known for their practical, innovative, and engaging teaching methods. We are well known for the success of our students who have achieved 9 Gold Medals and 143 Merits in CA (PRC & CAF) ICAP exams in different ca subjects and the legacy of excellence continues.

143 Merits Strong – Build Your CA Career with TSA

Modules We Are Offering:

Pre-Requisite Competencies (PRC)

- PRC – 1 Fundamentals of Accounting

- PRC – 2 Quantitative Analysis for Business ( Statistic + Mathematics)

- PRC – 3 (A) Business Insights PRC – 3 (B) Economics Insights

Hands-on Courses (HOC)

- Presentation and Personal Effectiveness (PPE)

- MS Office

- Data Management and Analytics; or Fin-Tech

Certificate in Accounting & Finance (CAF)

- CAF-1 Financial Accounting and Reporting

- CAF-2 Taxation Principles and Compliance

- CAF-3 Data, Systems and Risks

- CAF-4 Business Law Dynamics

- CAF-5 Management Accounting

- CAF-6 Corporate Reporting

- CAF-7 Business Insights and Analysis

- CAF-8 Audit and Assurance Essentials

Who Can Pursue CA at TSA? Your Pathway to Becoming a Chartered Accountant

Eligibility Criteria :

- Intermediate

- A-Levels

- B.Com, B.Sc & B.A

- Result awaiting students may also apply

Building Future Chartered Accountants: TSA's Comprehensive Training & Skill Development

At TSA, we prioritize practical experience and professional growth. After successfully completing the PRC and CAF levels, students are required to embark on a three and a half-year training program with an authorized firm. This training is pivotal as it offers hands-on experience, allowing students to apply their academic knowledge in real-world scenarios.

During this period, students will begin preparing for their CFAP exams after completing the first year and a half of their training. Passing the CFAP exams is a significant milestone, making students eligible to sit for the MSA papers, which are the final academic challenge before qualifying as Chartered Accountants.

In addition to technical proficiency, TSA places a strong emphasis on developing essential soft skills. Our Presentation and Communication Skills Course is mandatory, ensuring that our students not only excel in accounting but also possess the communication and presentation skills needed to lead in the professional world.

At TSA, we are committed to nurturing well-rounded professionals who are ready to make their mark in the global financial landscape.

Exemptions : For any assistance, feel free to call us (021) 111 064 065

4 Years Graduates from SDAI

- PRC : Exemption from all papers of PRC Without any other condition

- CAF: Exemption from all papers of CAF Minimum 75% marks or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subjects

4 year Graduates from non-SDAI

- PRC :Exemption from all papers of PRC Minimum 65% marks in aggregate 80% or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject

- CAF: Exemption from all papers of CAF-1 to 4 Minimum 65% marks in aggregate 80% or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject

HSSC

- PRC : Exemption from all papers of PRC Minimum 70% marks in aggregate 75% or equivalent grades in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject

- CAF: None

A – Levels

- PRC : Exemption from all papers of PRC Minimum two B grades B grade in relevant subject Syllabus matches at least 70% with the prescribed syllabus of relevant subject

- CAF: None

Calendar & Timeline : For any assistance, feel free to call us. (021) 111 064 065

Spring Session 2025

Autumn Session 2025

Frequently Asked Questions

Chartered Accountancy (CA) is a prestigious professional qualification in accounting and finance. CAs are experts in financial management, auditing, taxation, and business strategies. This qualification opens doors to a rewarding career with opportunities in top organizations, public sectors, and even global markets.

The time required to complete the Chartered Accountancy (CA) qualification typically ranges from 4 to 6 years. However, the exact duration depends on several factors, including:

- Study Progress: The pace at which you clear the exams for each level (PRC, CAF, CFAP, and MSA).

- Practical Training: A mandatory 3-year training period with an approved organization or firm.

- Consistency: Students who remain focused and consistent in their studies often complete the program sooner.

- Exemptions (if applicable): Some students may receive exemptions based on prior qualifications, which can reduce the time.

With dedication, strategic planning, and effective time management, you can achieve the CA qualification within the standard timeframe!

Absolutely! At Tabani's School of Accountancy (TSA), we prioritize helping students make informed decisions about their academic journey. To provide you with a glimpse of the learning experience, TSA offers Orientation Classes before admission. These classes allow you to explore our teaching style, interact with faculty, and get a better understanding of the curriculum.

Additionally, you can visit our official website at tsa.edu.pk to access a variety of demo classes for all CA exam levels. These demo sessions are designed to give you valuable insights into how TSA can support your journey to becoming a Chartered Accountant. Don't miss this opportunity to experience quality education firsthand!